University Insurance Group August 2025 Newsletter

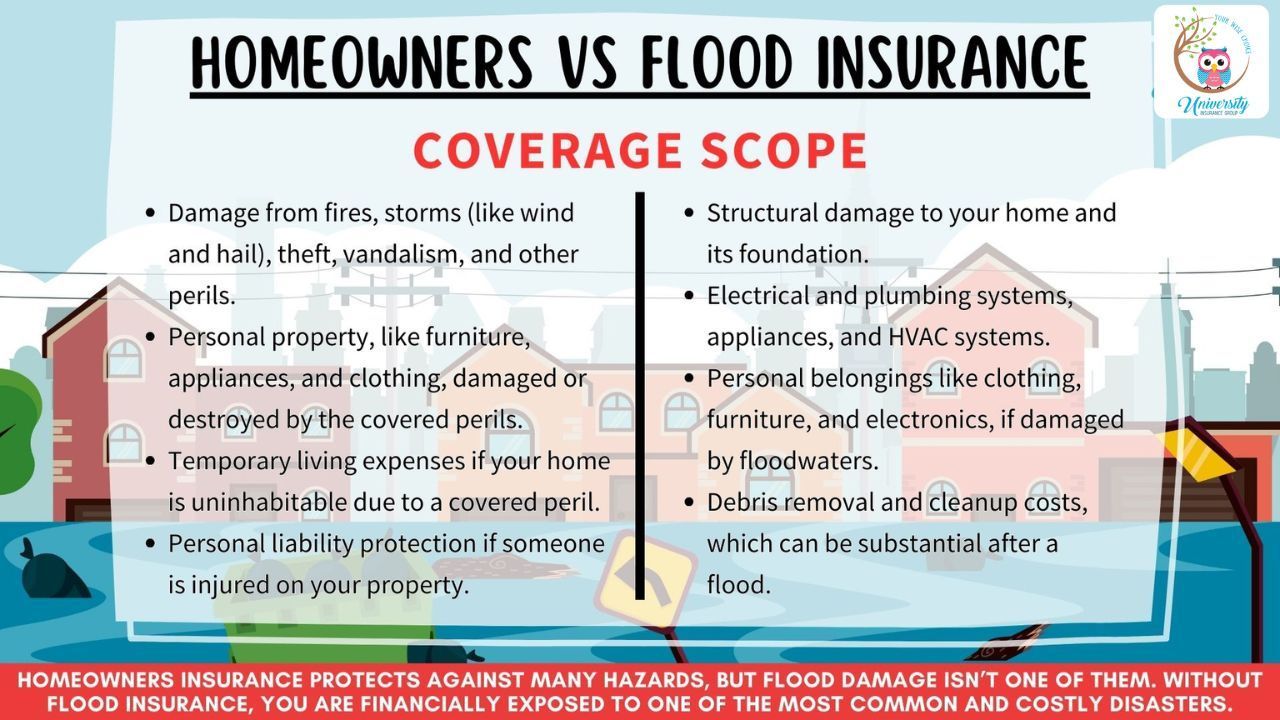

When most people think about protecting their homes, they focus on common risks like fire, theft, or storm damage. But there’s one major threat that’s often overlooked and it could cost thousands in damage: FLOODING.

🏠 "My Home Isn't in a Flood Zone. Do I Still Need It?"

Yes. In fact, more than 20% of flood claims come from areas not considered high-risk. Flash floods, heavy rains and hurricanes can lead to water damage in places you least expect. Unfortunately, standard Homeowners and Renters insurance policies do not cover flood damage.

💸 The Cost of Flood Damage

Just one inch of water can cause up to $25,000 in damage. Think about your flooring, appliances, electrical systems, furniture, and the emotional toll of losing valuables and memories. Flood insurance helps cover:

- Structural damage to your home

- Electrical and plumbing systems

- Appliances and built-in cabinets

- Personal belongings like clothes, electronics, and furniture

Without it, you’re left paying out-of-pocket or relying on limited federal disaster aid, if it’s available at all.

📅 When Should I Get Flood Insurance?

Now. There’s typically a 30-day waiting period before most Flood policies take effect, so waiting until a storm is forecasted could be too late. Getting ahead means peace of mind.

🤝 How Can We Help

At University Insurance Group, we make getting Flood insurance easy. Our licensed agents will:

- Review your property’s risk

- Compare coverage options and prices

- Help you understand what’s covered and what’s not

- Answer any questions you have. No pressure, no jargon

Don’t wait for the next storm to think about Flood insurance.

Reach out today for a free, no-obligation quote.

You might be surprised how affordable it is and how much it could save you in the long run.

📞 Call us or send us a message, and we’ll help you stay dry and protected - rain or shine!

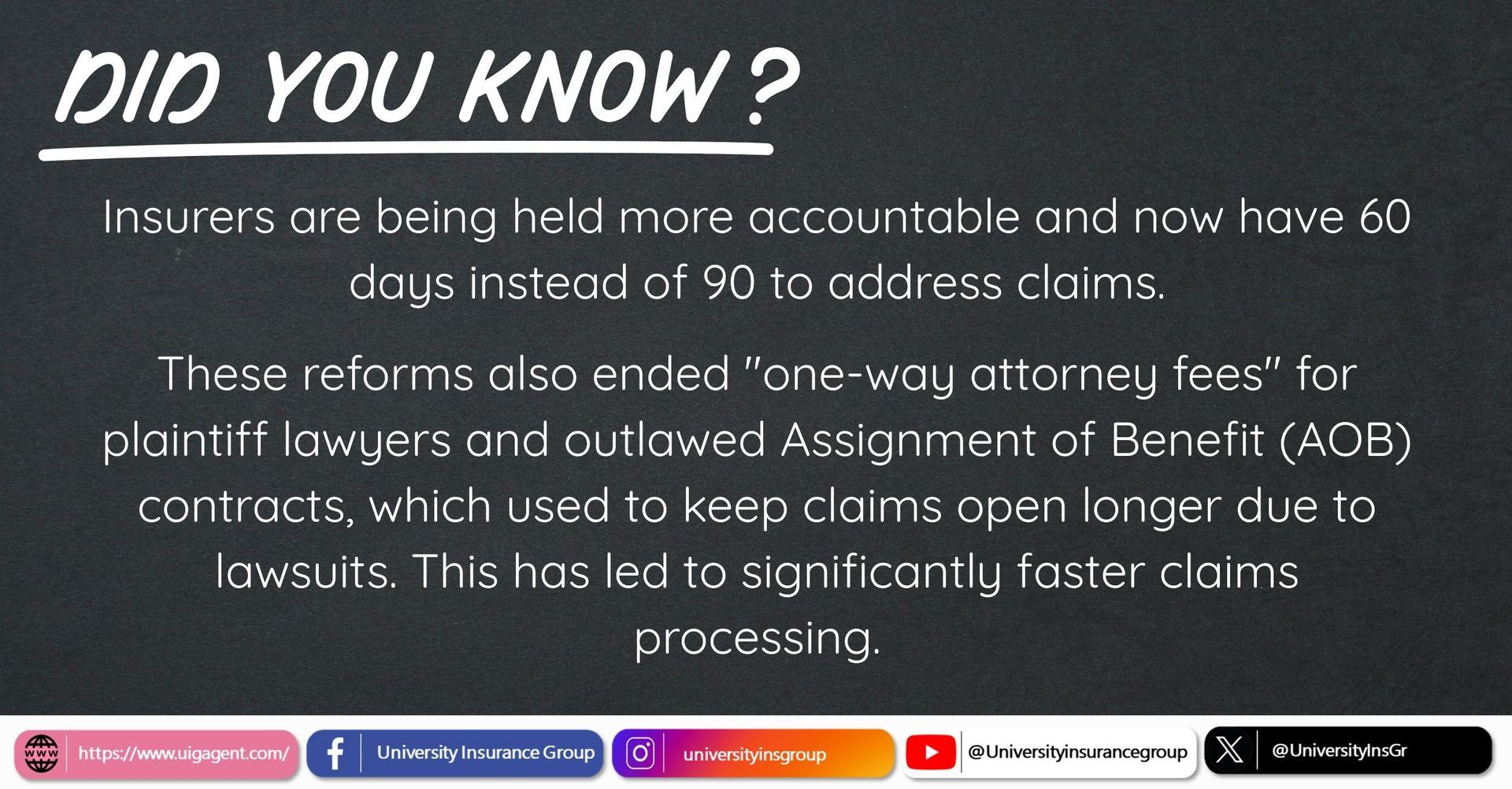

On Homeowners claims, the data shows that 56% of Helene residential claims have been closed without payment and about 43% of Milton residential claims. The majority of those unpaid claims were flood damage not covered under a Homeowners policy or the damage was below the policy deductible.

Check out this recent podcast featuring insurance experts Lee Wiglesworth and Fraser Hudson as they talk about

Episode 58 – The 17 Reasons Your Florida Claim Wasn’t Paid.

FURTHER READINGS:

We’ve rounded up several articles from around the web that are particularly relevant for this time of year. Enjoy!

- This will help put summer heat in perspective: NASA’s Parker Probe got closer to the Sun than any spacecraft ever and captured the closest photos we’ve ever seen. Suddenly, 90 degrees doesn’t seem so bad!

- Anticipating carpool line blues? See how one school got creative and turned the daily wait into something a little more fun.

- Thinking about moving or upgrading your space? Check out these 30 ways to boost your home’s value — from low-cost fixes to big-impact updates.

- A field, a tractor, and a message of love: One farmer found a unique way to celebrate 20 years of marriage. Have a look here!

MARK YOUR CALENDAR

Here are some notable dates you don't want to miss, along with ways to celebrate each:

- August: National Eye Exam Month - If it’s been a while since your last eye exam, consider scheduling one for yourself or the kids, especially before back-to-school.

- August 4: National Chocolate Chip Cookie Day - No better excuse to indulge. Whether you bake a batch at home or pick up a warm cookie from your favorite local shop, it’s the perfect day to share something sweet with a neighbor or client. If you don’t have a tried-and-true recipe, give this Crumbl copycat a try!

- August 8: National Sneak Some Zucchini Onto Your Neighbor’s Porch Day - This offbeat holiday is a nod to overzealous gardeners with an abundance of zucchini and a lack of recipes. It’s also a fun reminder that random acts of generosity (and produce) can bring communities together.

- August 18: World Breast Cancer Research Day - Today is a day dedicated to recognizing the progress made in breast cancer research and the importance of continuing that work for future prevention and treatment. The date itself — the 18th day of the eighth month — is a meaningful reminder: One in eight women and one in 833 men will be diagnosed with breast cancer in their lifetimes.

- August 26: National Dog Day - Our furry friends are part of the family. Celebrate by updating your emergency plans to include pets. If you’re a homeowner, it’s also a good time to make sure you understand how pets may factor into your liability coverage.

- August 31: National Eat Outside Day - Soak up the final days of summer. Pack a picnic, fire up the grill, or just enjoy lunch on your patio. Just don’t forget the bug spray.

That's all Folks!

Thanks for reading this month's newsletter.

If you have any insurance needs, questions, or concerns, please reach out.

We are here to help.